Bill Gates' stock portfolio, adjustments and impact on Berkshire Hathaway

Findings from 13F Reports for the First Quarter of 2024

Bill Gates, the industrialist and philanthropist, recently made significant adjustments to his investment portfolio according to his latest 13F filing for the first quarter of 2024. Gates, who co-founded Microsoft in 1975, was a prominent figure in technology and global philanthropy. His investment decisions, managed by the Bill & Melinda Gates Foundation since June 2009, are closely monitored for insights into the strategies of one of the world's richest men. The fund's investments are based on a commitment to good governance, stewardship and ethical considerations that are consistent with the fund's objectives.

Reduction of key positions

In the first quarter of 2024, Bill Gates decided to reduce his stake in two major stocks, reflecting a strategic shift in his portfolio. Adjustments include:

- Berkshire Hathaway Inc (NYSE:BRK.B) shares decreased by 2,613,252 shares , resulting in a stock decline of -13.12% and a portfolio impact of -2.2%. The stock, which traded at an average price of $393.34 during the quarter, has returned 2.43% over the past three months and 15.87% year-to-date.

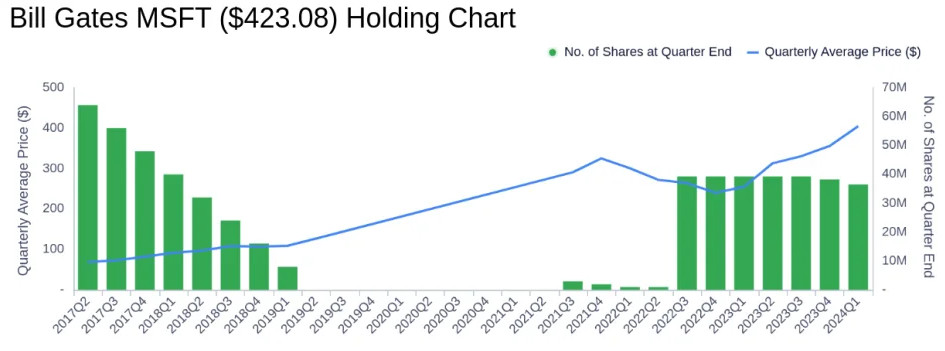

- Microsoft Corp (NASDAQ:MSFT) shares decreased by 1,711,272 shares , resulting in a stock decline of -4.48% and a portfolio impact of -1.52%. The stock's average trading price for the quarter was $404.82, with a return of 4.25% over the last three months and 12.92% year-to-date.

Bill Gates Portfolio Review

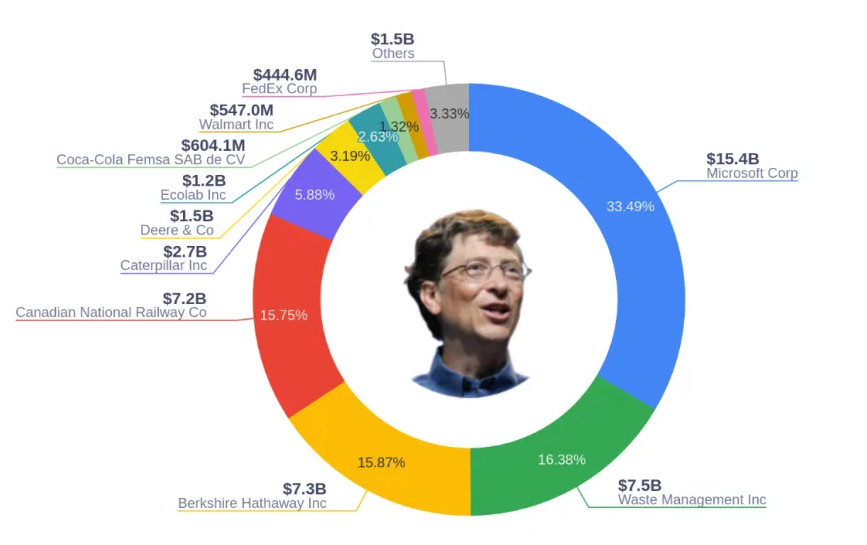

As of the first quarter of 2024, Bill Gates' investment portfolio (Trades, Portfolio) included 24 stocks. The largest holdings were highly concentrated in a few key companies and industries, reflecting Gates' investment strategy and market outlook. Major holdings included:

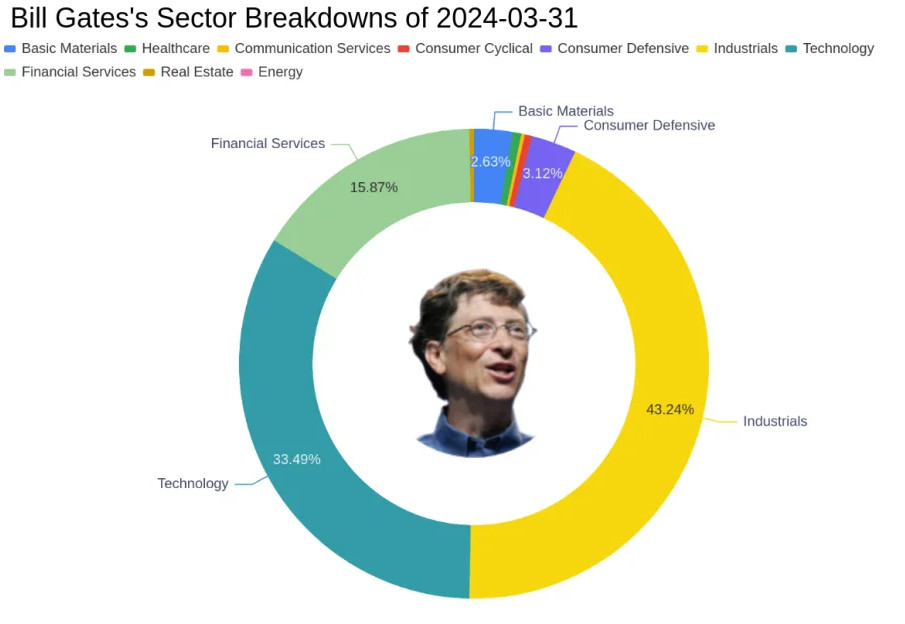

33.49% in Microsoft Corp (NASDAQ:MSFT), 16.38% in Waste Management Inc (NYSE:WM), 15.87% in Berkshire Hathaway Inc (NYSE:BRK.B), 15.75% in Canadian National Railway Co (NYSE:CNI), and 5.88% from Caterpillar Inc (NYSE:CAT). These investments span various sectors such as industrials, technology, financial services, consumer protection and others, indicating a broad but focused investment approach.

The strategic cuts and allocations in Gates' portfolio highlight a careful approach to capital allocation that is influenced by both market performance and the fundamental principles of the Bill & Melinda Gates Foundation. Investors and analysts will be closely watching to see how these changes may signal broader economic trends or strategic shifts in the investment landscape.