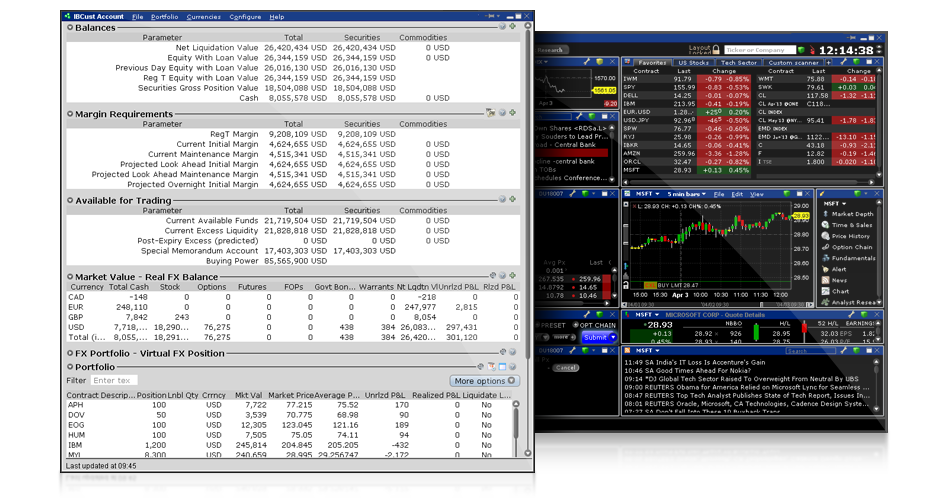

Trader Workstation Trading Tools

All trading tools are included in the trading platform and are fully integrated into the Trader Workstation (TWS).

Our advanced trading tools are designed to enhance the trader's trading efficiency and enable you to get the most out of your trading on exchanges and financial markets.

Different traders have different trading needs for their strategy. With such a wide range of trading tools, a trader can implement any of his trading strategies.

Click on the icon below to find out more detailed information about the trading instrument

Trader Tools Overview on TWS Platform

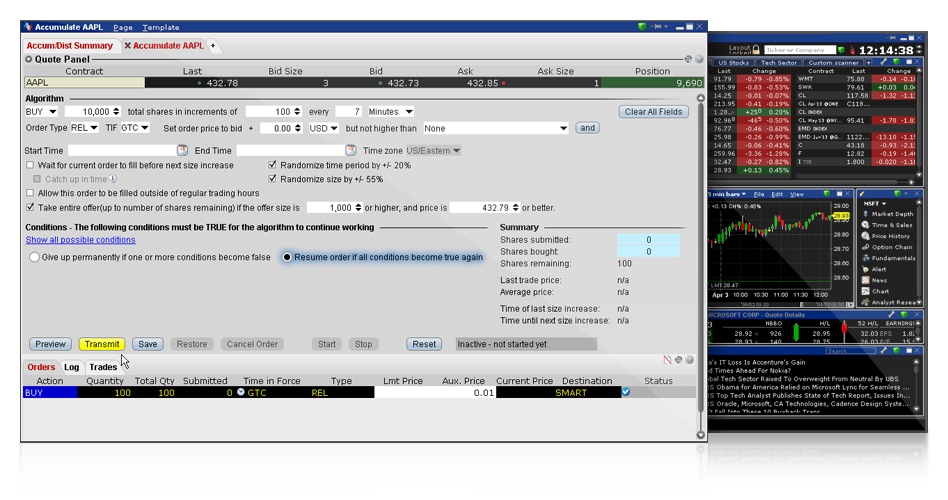

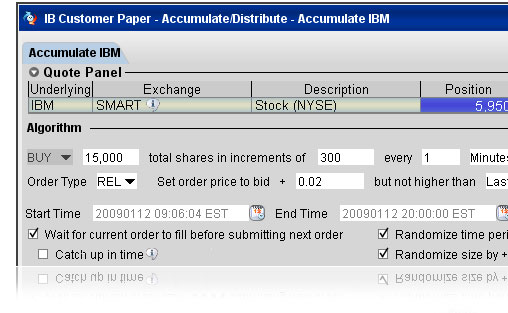

Accumulate/Distribute Algo

Dividing large orders into small ones, and their execution at certain time intervals. The sequence of accumulation and distribution will help in achieving the best value for orders with small volume, while remaining unnoticed in the market. Also, an important role is played by a convenient interface that allows a trader to simultaneously manage several large orders.

Dividing large orders into small ones, and their execution at certain time intervals. The sequence of accumulation and distribution will help in achieving the best value for orders with small volume, while remaining unnoticed in the market. Also, an important role is played by a convenient interface that allows a trader to simultaneously manage several large orders.

- This tool allows you to:

- Customize working conditions of different levels of complexity, with the ability to use random prices, terms in conjunction with a quick response to market fluctuations and trends.

- The size of the order and the time of sending remains unnoticeable in the market.

- Using the required router (route) in order to add liquidity and use the available premiums from positive rebates.

- Several tabs embedded in one window provide a simple interface that allows a trader to create, modify and control groups of orders with a large set of algorithms overnight.

- An instant summary shows the online execution of orders.

- Synchronization with the TWS terminal gives you quick access to other analytical trading tools such as ScaleTrader, which is an integrated analytical window with charts.

- Support for a variety of asset classes: options, stocks, forex and futures.

More about Accumulate/Distribute

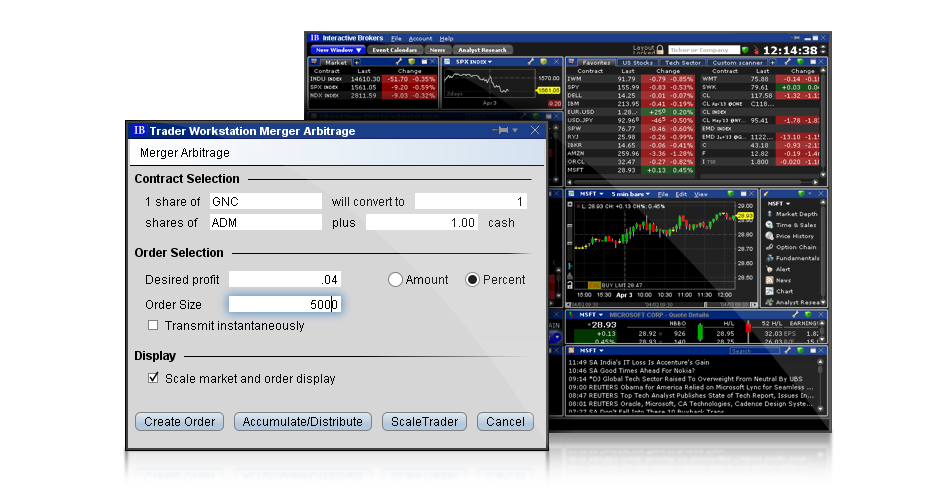

ArbTrader

Arbitration in the course of trading financial assets. Using more advanced trading tools allows you to create combinations of orders during expected mergers and manage orders in the Quote Monitor of this terminal. TWS Merge Arbitration is compatible with these types of merges:

- Shares and share swaps in a merger, where the buyer is asked to exchange his shares for others.

- A cash merger in which a buyer is asked to buy shares for a specified amount of money.

- By taking advantage of TWS merger arbitration, you will experience the following benefits:

- Quick and easy creation of a combination of orders so that in the event of an expected merger of companies, it would be possible to trade from a single window.

- Quick access to the prices of combinations of stocks of companies.

- Management and creation of orders in the quotes window and combination with other windows: Accumulator / Distributor or ScaleTrader.

BasketTrader

Trade and create a basket of financial contracts, as well as create an index of your basket with global order management. Simply put, this tool allows investors and traders to trade a basket of assets.

With this tool, you can create an index or a group of major components and store them in a basket. In one window, you can trade basket assets, monitor pending orders and update prices and track a profile.

- BasketTrader has the following features:

- Quickly create a basket of orders.

- Formation of a basket, starting from the composition of the index and setting up all components of the index, depending on market capitalization, weight, price range, company symbol.

- Simple change and adjustment of parameters for the entire basket or replacement of an order with an order.

- Change the order and side of the order in one click.

- Cancellation of unfulfilled orders in one click.

- Using arbitrage opportunities in a basket of trades.

- Monitor the total number of shares and the value of the basket of orders.

- Creation and correction of basket files in MS Excel.

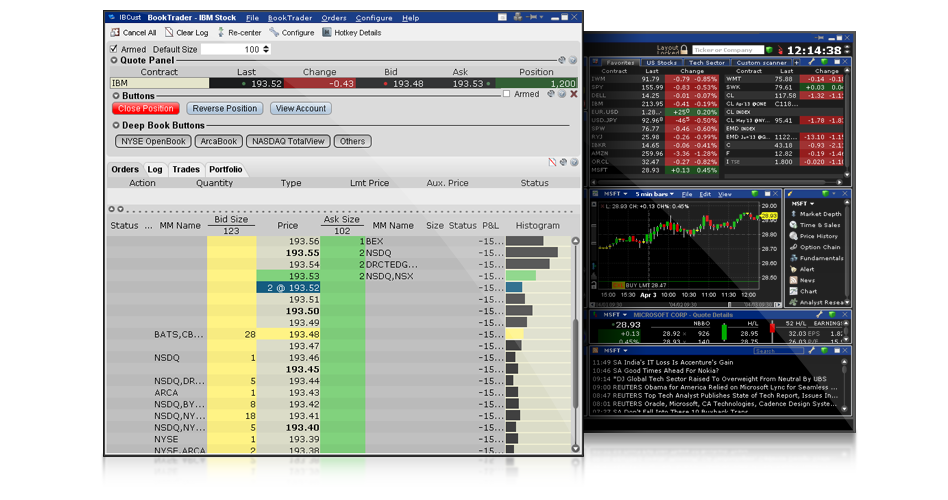

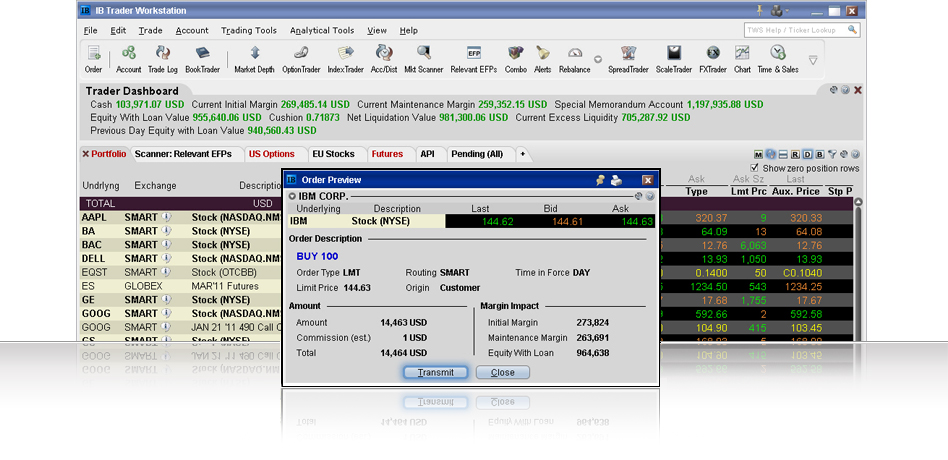

BookTrader

With this tool, you can optimize trading speeds and execute orders with a single click, forming it at the best bid and ask price, using the full depth of the market.

- With BookTrader you will experience the following benefits:

- Formation of an order with one click of the mouse.

- Adding a position to the buy and selling field, as well as sending an order.

- Customization and creation of hot keys to support various types of orders.

- Monitoring supply and demand prices in the context of the price ladder.

- To help traders, a special graphical price indicator has been created, which has a special marking in order to quickly determine the best bid and ask price, order status and type, and a trading range.

- The created order is tied to a specific symbol.

- With this tool, you can open multiple windows at the same time, which affects the optimization and efficiency of tading.

- It is possible to select an advanced mode for working with the keyboard and forming the order of orders.

- The TWS template is made up of customizable quote lines and order orders to provide complete and efficient order management.

ChartTrader

This tool allows you to get acquainted with the technical analysis of time, has in its set of line and candlestick charts, a set of tools and indicators for a complete and comprehensive technical analysis. TWS real-time charts provide traders with the following benefits:

- Scale and flexibility

- Arrangement of both one and a set of charts in one dialog box.

- Comparison of multiple asset charts in one window.

- The ability to use the Chart Dashboard to personalize the chart by type, time period and display.

- Market data is displayed on a chart, allowing you to optimize your time and respond quickly to market fluctuations.

- Monitoring of time and price ranges through horizontal and vertical scrolling.

- Possibility of setting data viewing depending on the time from one minute or more.

- Adding indices as reference points for comparative analysis of several charts.

- Integration for trading

- Formation, modification, management and transmission of orders to the ChartTrader control panel.

- Individual setting of notifications, depending on the price, time, price and other criteria on the chart.

- The ability to send orders from charts in one click using hot keys.

- Customization

- Quickly and easily add annotations and trend lines to charts.

- The ability to customize based on your own trading style.

- Quick access to the toolbar and its functions.

- Create a collection of frequently used charts and overlay them on other underlying assets.

- Debugging the volume right on the chart in order to notify the trader about the price reaching a given level.

- Tracking prices on a chart using an indicator.

- Technical Indicators

There are many indicators that can be used for technical analysis: exponential, weighted moving averages and simple ones. Williams indicators, stochastic, MACD and others.

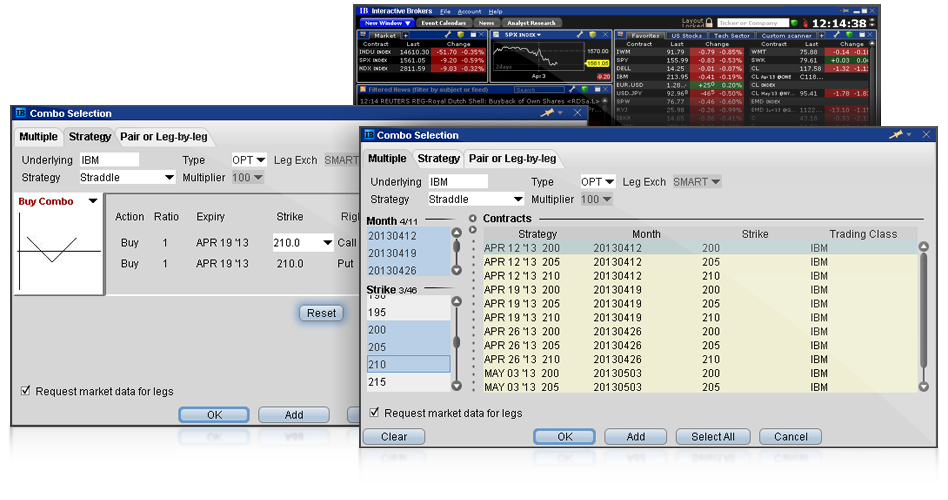

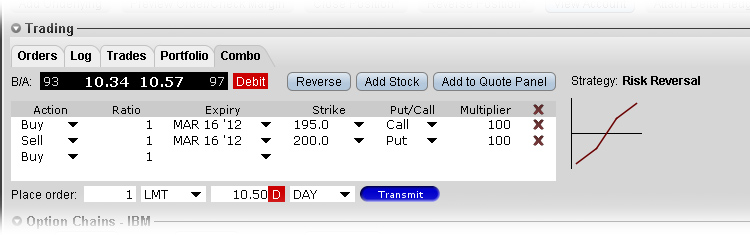

ComboTrader

With this tool, you can create unique combinations of orders that are executed in stages, or create complex combinations of orders using a variety of strategy templates. With this tool, order combinations are created using the Combo Selection tool.

- Combo Selection Tool

The TWS Combo Selection tool is used to:

- Indication and formation of step-by-step combinations.

- Formation of an individual set of order combinations.

- The ability to choose a suitable template out of 18 in order to form your own strategy.

- Combinations of orders

Creation of a combination of orders with Trader Workstation using the Combo Selection tool provides the following opportunities for traders:

- Form order combinations including options and Smart, EFP and futures spreads.

- Ability to display a combination of orders from the Order Ticket or Quote Monitor.

- Using SmartRouting for single orders to ensure the best order price.

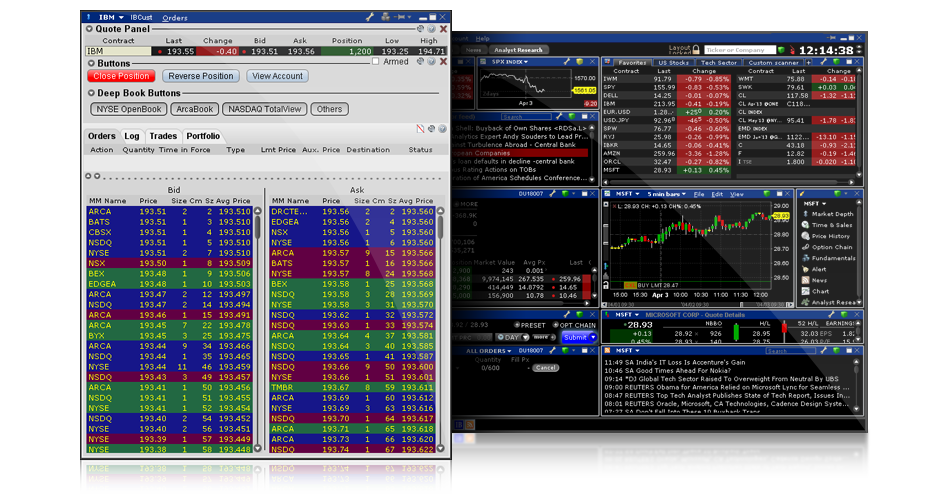

DepthTrader

This tool allows you to track liquidity and market depth, trading volume with price monitoring. Contains NYSE and TotalQuotes Deep Book that you can easily subscribe to. DepthTrader is a user-friendly graphical interface that makes it easy to analyze market liquidity. The Market Depth tab allows you to more clearly see the market liquidity, supply and purchase within currency pairs. Market depth shows the cumulative number of orders with their value.

With TWS Market Depth, the trader gets the following opportunities:

- Possibility to subscribe to Level 2.

- Graphic coding that allows you to quickly respond to market fluctuations.

- Quickly create opposite orders, which allows you to change your position from short to long and vice versa.

- Debugging for individual requests of the Market Depth window.

- Automatic creation of an opposite order to close the current position.

- Fast restructuring, treason and order sending.

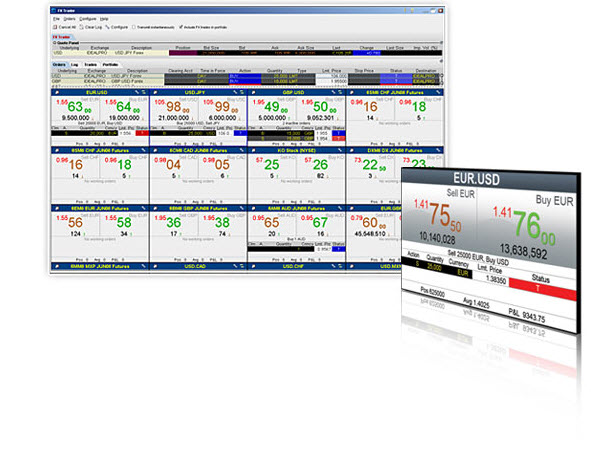

ForexTrader

This tool allows you to trade in a specially adapted FXTrader window, which includes indicators of trading volume, real-time quotes, positions, orders, average price, as well as a balance of losses and profits.

FXTrader provides quick access to quotes on the interbank market with the most favorable conditions in the world, no extra charges, a transparent payment system and a low commission rate.

As a result of long and thoughtful work, we have the opportunity to have high liquidity and tight spreads, which was the result of the consolidation of a group of quotations from 13 of the largest forex dealers from around the world. They account for about 70% of the market in the interbank market. Due to our success, we are able to offer clients the lowest spreads of 0-0.5 pips and the lowest commissions.

- You are getting:

- Quick access to quotes on the interbank market. No hidden commissions and spread markups, only a transparent system. Taking into account prices from thirteen FX of the world's largest banks.

- ECN market structure. The order book makes it possible to send orders to the market and guarantee and provide liquidity to banking entities.

- Forex leverage and conversion. We provide leverage to clients in the course of currency trading. Also, accounts have the feature of the ability to convert one currency into another without using leverage.

- To use forex leverage, you will need additional permissions and the skill level must be at the appropriate level, which will allow you to trade on the market with leveraged funds.

- Automatic recalculation of positions at the end of the working day.

- With our company, you do not pay for automatic recalculation of positions overnight, and swaps are carried out at the level of the best quotes of the company's partners on the interbank market.

- Trade in nineteen world currencies. USD, NZD, RUB, AUD, CNH, DKK, SEK, CAD, CHF, HKD, GBP, MXN, HUF, ILS, JPY, EUR, NOK, SGD and KRW, and their fast conversion.

- Reliability and safety. Our company, a member of the Interactive Brokers Group, has a capital of more than $ 5 billion, as well as insurance and protection of funds, regulation of client accounts.

- FXTrader. This option allows you to trade the forex market in an optimized dialog box that includes up and down indicators, quotes, order execution, trading volume, client positions and average price (loss and profit).

- The commission is fixed at the lowest level. Commission companies start at 0.10 basis points, depending on the size of the bet.

- FXTrader is an optimized trading interface with tools from our company for convenient and efficient Forex trading.

A specially designed color display combined with graphic elements shows supply and demand. An increase in prices is indicated in red and a decrease in red. For the convenience of a trader's trading, each currency takes its place, all this data is combined with market data and the necessary information about the order, which can be easily formed, sent, modified and canceled with a single click of the mouse, as well as thanks to specially programmed hot keys. General data about your trade order and portfolio is located at the top of the grid of currency pairs.

- Through interbank quotes, you will get the best spread from several liquidity providers at once, with spreads from 0 pips.

- A unique opportunity to trade simultaneously from one Forex account with Globex in currency futures.

- Using this window, you can conduct not only forex trading, but also conduct any ticker for trading and monitoring from the same window.

- The trader can view the detailed order and marker before placing or submitting orders by entering the market with one click.

- The FXTrader window is synchronized with over fifteen order types, including OCA, trailing stop, IOC, etc.

- Also, having adjusted to your preferences, you can customize the order of displaying trading cells to monitor positions, profit and loss, as well as the average price of assets.

- The Order Book tab will notify you about the best order price and when the price will be available for the currency pair.

- Based on your individual requirements and preferred trading style, you can customize the template, change the color scheme, and deeply customize the general parameters for the most comfortable use of FXTrader.

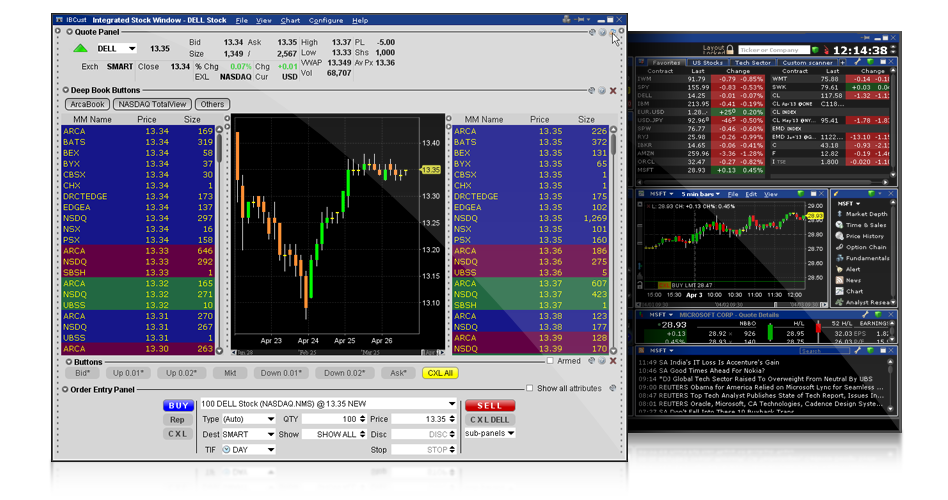

Integrated Stock Window

The Integrated Stock Window is a dynamically customizable window that includes all of the data and order management tools needed to operate a trader, analyze the market, monitor activity, place and send orders, and make trading decisions.

- This application allows you to pick up all the necessary elements to work, including Level I and Level II data, account, charts, instant order entry and trading information.

- The ability to form all types of orders, from a simple Limit order to a whole set of Algos orders, through the Order Entry Panel and its sub-panel, the price key and a multifunctional and understandable drop-down list.

- To switch between text and tabular views, use one click on the quotes display.

- Debug and adjust Level II, quickly add market data to the ISW dialog.

- Intuitive interface and easy access to TWS trading tools: OptionTrader, BasketTrader, FXTrader, BookTrader, SpreadTrader, Rebalance.

- All pending orders are highlighted and located in the ISW Deep Book column, for the purpose of convenient tracking by the client of the place of the order in the book.

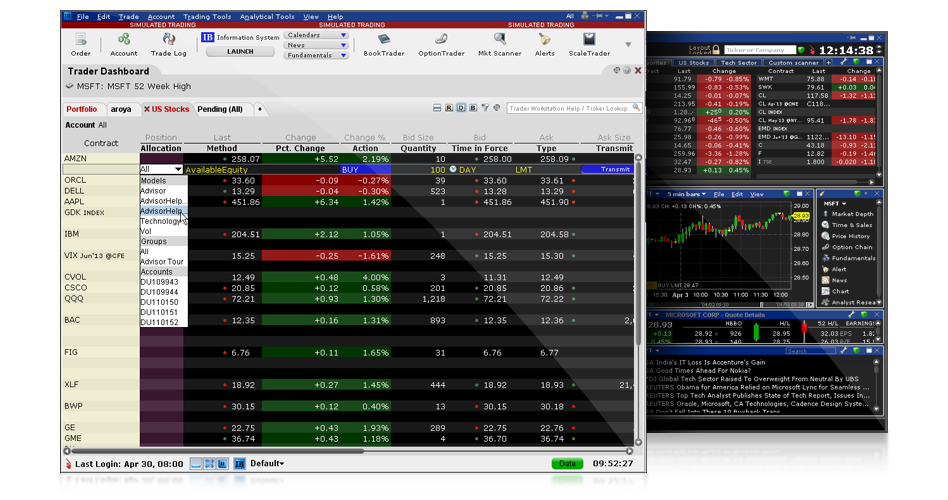

Mosaic

Mosaic is an intuitive workspace that features a user-friendly interface with easy access to complex trading, charting, portfolio monitoring and order management.

Mosaic is characterized by the following advantages:

- Full access to the TWS terminal, order management, trading, access to analytics and technical research, live quotes, in one window with a convenient and multifunctional interface.

- Debug the Mosaic workspace based on your needs and preferences by combining the tools you need.

- Using the Portfolio tab to detail the account, the Order Entry window to send and create orders, and the Order Monitor to monitor and modify orders, view canceled and pending orders.

- Accessibility allows you to add multiple asset overview sheet options and generate custom Market Scanners.

- Add lines and bars, gradients in order to detect and search for trends and patterns by Mosaic Market Scanners.

- Monitor and analyze charts, conduct technical analysis.

- Tracking the latest news with the ability to set filters on a specific topic or on a selected asset.

- Subscription to a universal information system, in order to receive information, analytics and news from the world's best news providers: Reuters, Morningstar, Dow Jones, Zacks.

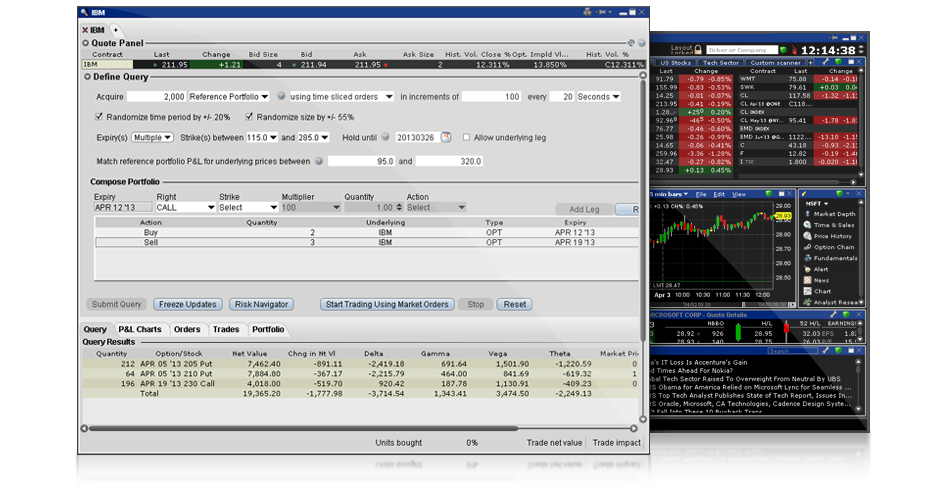

Option Portfolio

Use the TWS Option Portfolio to get the most out of your option strategies and customize your risk profile.

This tool gives full access to data on the options market and searches for the most effective solutions so that the client can achieve the set goal, taking into account option premiums and commissions.

- For global monitoring of market changes, the algorithm continuously monitors the best conditions and prices, updating its data every half a minute.

- The convenience of the tool is due to the fact that you can change the criteria at any time, and the program monitors them and issues an updated list in real time.

- Option portfolio is consolidated with Navigator - a risk management platform

- The option portfolio is used to trade stocks and indices of the United States of America.

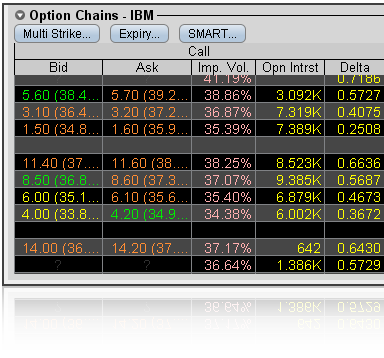

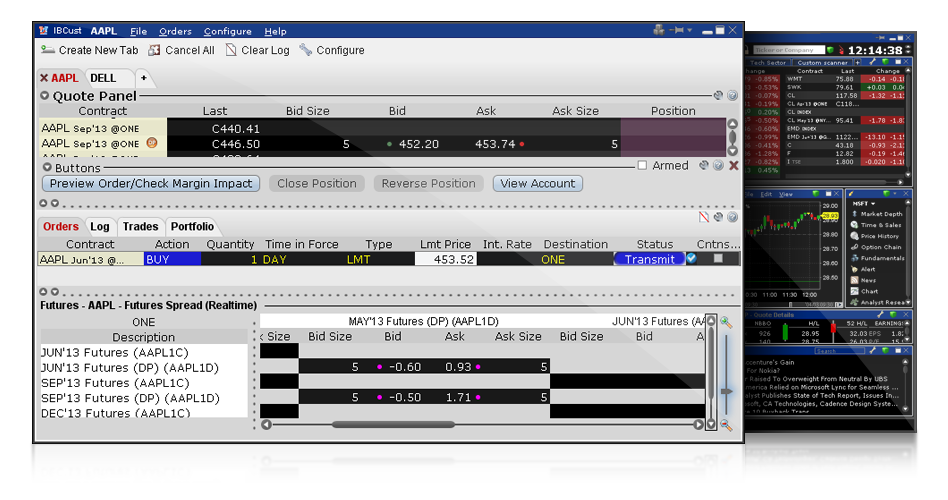

OptionTrader

OptionTrader Tool - Allows you to trade and analyze options.

OptionTrader provides market data and allows you to manage and create option orders, including order combinations. This tool provides fundamental data about options available for trading.

OptionTrader provides the trader with the following benefits:

- Instant order entry.

- Customizable format.

- Management of options orders in one window.

- Calculating the fair value of the option contract.

- Displaying volatility for a contract.

- Displaying the size of the risk.

- Color-coded values for visual and quick reference.

- View open positions for options.

- Consolidation with platform and tools (Options Analytics, Model Navigator, Risk Navigator).

- Combo Tab

The OptionTrader Combo tab offers a fast, easy and accurate way to create and place Combo orders.

The Combo tab is used by traders to:

- Analyze the prices of options that are in the Quote panel.

- View all available bundles or filters for a specific contract.

- Use the Statistics panel to view open interest, volatility and volume, and other statistics for an option.

- Customize the data displayed by adding or removing columns to calculate price, implied volatility, open interest, and Greek letters.

- Trade using volatility rather than option premium.

- Automatic hedging of option risks using Delta.

- Creation of several pages with options for different securities.

- Add "Display size" to work with large orders.

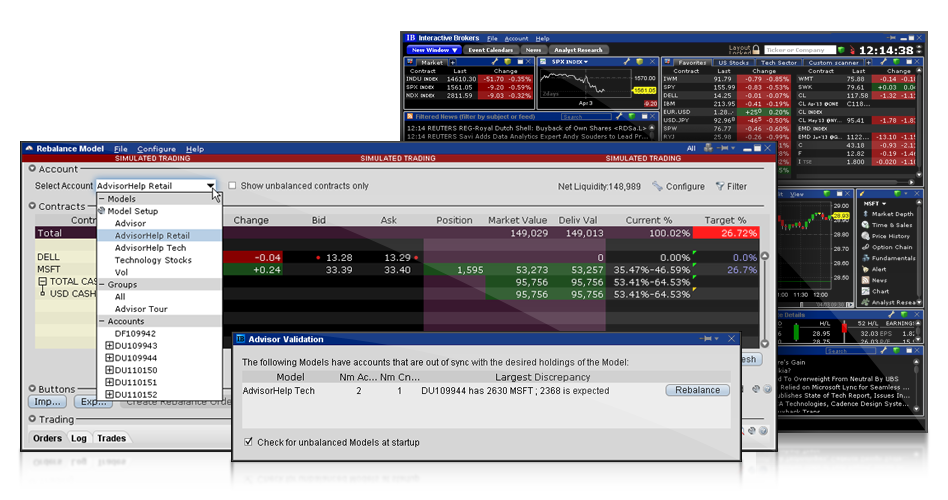

Model Portfolio

TWS Model Portfolios offer our partners efficient trading access, save time and a more organized approach to investing clients' assets.

Models allow our partners to create groups of financial instruments for specific investment topics and invest clients' funds in these model groups, instead of investing in a single instrument.

Model portfolios are used to manage and invest several Clients' accounts, namely:

- Manage multiple trading strategies for each individual client without requiring Clients to open a live account with us.

- Quickly and automatically accumulate investments from multiple customer accounts into a single model.

- Speed and time minimization for the execution of individual trades.

- Using model portfolios as mutual funds.

The models can be invested in any type of asset - stocks, options, futures, forex, bonds and funds.

Pre-Trade Allocations

Investment managers and professional advisors use Pre-Trade Allocations - Allocation before trading, in order to distribute a trade among several client accounts.

Pre-Trade Allocations enable traders to:

- Create stock group accounts based on a single method for a group of accounts.

- Define a variety of criteria in order to automatically place shares in several or one client account.

- Create Allocation Profiles Allocation Profiles, allocating a percentage or shares of each order on an individual account, according to their own rules or values.

- Generate a default distribution that is used automatically during order creation.

- Register new accounts.

- Change the distribution from one order to another.

- Placing orders from the TWS platform.

Rebalance Portfolio

The Rebalance Portfolio app allows you to quickly and easily balance a complete portfolio of all asset groups, making it easy to change assets and adapt to your investment goals and risks.

This tool gives traders the following advantages:

- A professional consultant can automatically restore the balance of all customer accounts, group of accounts and sub-accounts.

- Automatically close and open positions to balance the entire portfolio based on a new percentage distribution set by the user.

- Create an order or add a contract in the same way as for TWS Quote Monitor.

- Instant change in the amount of assets in the trader's portfolio in accordance with the client's risks.

- Export Rebalance to a Microsoft Excel document, change the current percentage, taking into account the percentage of liquidation and replace positions in Microsoft Excel, and then import the resulting file back to the application.

Market Scanners

Market scanners are a tool that helps you track the markets and find the best performing contracts, futures, options, stocks, indices, bonds and other assets.

This tool allows you to:

- Configure any scan parameters that are set by the user for all search options: exchange, type of instrument, price and volume, industry, sector, etc.

- Tracking many products around the world. Scanning according to top contracts in stock markets, US options, indices, futures, EFP and SBL, corporate bonds, Asian and European stock markets, indices, futures.

- The ability to use the most popular scan options. The platform offers users the most useful and popular scanning options: Top Gainers and Losers: High Dividend Yield, Hot by Price and Volum, Highest and Lowest Option Implied Volatility (maximum and the minimum option volatility), Most Active (the most active), Top Trade Rate (top trades) and a summary of the breakout of the weekly 13, 26, 52 levels from the bottom or from the top.

- Save favorites. Each user can customize the scan list, which is used to check every day. You must enter your scan parameters and name the scanner that will be used in the future.

- Formation of custom scans. Customizable scanners and filters let you generate fully customizable scans. The user can find the five most active US stocks under $ 30 in real estate only. You can also set various filters by rating and absolutely all available parameters.

- Two-click scanning. All you need to do in order to start or change the scan parameters is to open the editing panel, select or delete a filter criterion and click search. The TWS Market Scanner platform will do the rest for you.

- Run a scan after the market is already closed. Using this tool, you can use data from the previous session to get a statistical snapshot of the state of the market close. Note: The tool is not available for scanning bonds and EFPs.

ScaleTrader

ScaleTrader is a flexible automated trading algorithm that allows you to trade constantly in the same price range, or to gain orders for a large position without exposing prices to deterioration.

This tool helps you find the best buy price in a falling market, choose the lowest prices, or sell in a growing market at a high price.

TWS ScaleTrader provides the following benefits:

- Pair trading and Combos. The intuitively simple interface makes it possible to set up and control volumes while trading financial assets.

- Support for multiple assets. Use this application for most of the products that our company offers: options, stocks, forex, futures, bonds, excluding mutual funds.

- Market direction change. The instrument can be programmed to buy and sell multiple times during market fluctuations.

- Automatic Profit-Taker (Take Profit). Automatic profit taking when the position has reached the set trading target.

- Price protection of orders. Automates large order volumes in order to protect trades from price deterioration.

- Liquidity Rebates - the instrument can be used to profit from positive rebates by providing liquidity to the market.

SpreadTrader

This tool helps to easily and easily manage futures spreads on one screen. This significantly reduces time spent and helps to quickly respond to any changes.

SpreadTrader provides the following benefits:

- Create a spread order in one click, for this you need to press the Ask or Bid key on the price - sell or buy.

- The ability to manage and create calendar futures spreads, option spreads for multiple underlying assets and EFP futures spreads in one screen.

- Check the mark of the order before placing it with one click.

- Show and change positions quickly and easily.

- Adding a tab to the page in order to manage orders of several assets.

- The spread price is updated in real time during each price step.

- The tool is fully consolidated with the platform, which gives access to the account window and configuration options.

Technical Analytics

Technical Analytics technical analysis is real-time market scanners and charts that allow you to monitor and filter data in order to quickly respond to market changes. Scanners and charts include analytical data to help figure out trading opportunities in the options and stock markets.

- Real time charts

- Graphs allow you to track data over a time interval from one minute to five years.

- You can select the type of chart - bars, lines or candles.

- Depending on your trading preferences and trading style, you can adjust time parameters, draw lines and add a ribbon to the chart.

- Using ChartTrader to create, modify and send an order without leaving the chart.

- Volatility charting, including option and historical volatility, option volume and open interest option.

- Formation of interactive charts in the TWS or WebTrader platform.

- TWS Technical Studies (technical studies)

- Technical research allows you to track market bottoms and peaks, patterns, trends and other factors that affect stock price fluctuations, as well as add technical research data directly to charts.

- Large selection of indicators - weighted, simple, and exponential moving averages - weighted, simple, and exponential moving averages, Envelopes, Bollinger bands, Relative Strength Index, ADX / DMI, MACD, On Balance Volume, Ultimate Oscillator, Williams Oscillator, Stochastic Oscillator, Momentum , Average True Range, Parabolic SAR, Rate of Change.

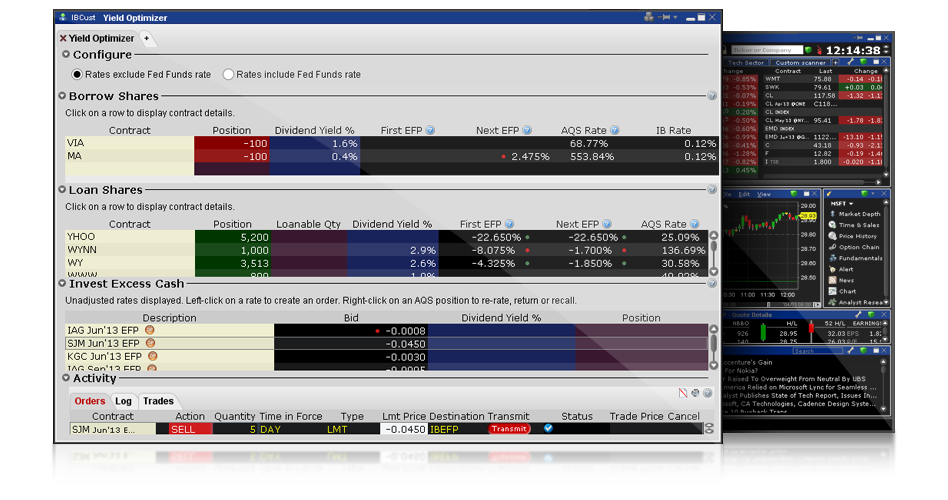

Yield Optimizer

The Yield Optimizer allows you to borrow stocks before taking a short sell position. This tool allows you to use a variety of borrowing strategies, as well as view the best prices and look for the most effective ways to invest the trader's money.

Yield Optimizer gives traders the following benefits:

- Borrowing price comparison. When selling shares, use Borrow Shares - Borrow shares in the Yield Optimize column. In this section, you can compare prices from the sale of EFP, borrowing through AQS or borrowing them from our company. You can create an order by getting the best rates.

- View ticker details when borrowing. Borrow Shares allows you to quickly view your ticker bets. Use the ticker panel to see the borrowing rates for all EFPs.

- All long positions are shown in the Lend shares panel. Use the ticker panel to borrow shares.

- Track the current rate. When taking a short position, they will be shown automatically when you open this application. To see the fee and borrowing rate, use the panel details to view positions.

- Investing free funds. If the client has free funds on the account, this is an excellent opportunity to receive additional profitability by investing these funds in EFP.

Credit Manager

Credit Manager is an innovative technology that provides online risk management. The main functions are credit compliance and risk management.

Credit Manager provides the following benefits:

- Shows margin requirements and account balances.

- Signals when there is a lack of margin.

- Carries out the liquidation of positions. The client can specify which positions should be liquidated last.

- Carries out an automatic transfer of funds in the client's account between goods and securities.

- Tracks creditworthiness for sending orders, DVP transactions, ACATS, IBG, cash withdrawals.

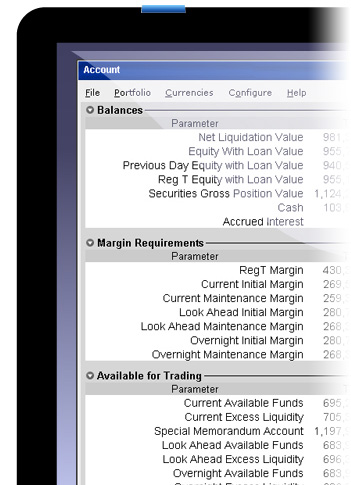

Real-Time Activity Monitor

- Real time monitoring

Our company strives to provide information and all the necessary information in real time so that each client can get the most profit from transactions. That is why, unlike other brokers, you, a client of our company, will receive real-time margin data.

In the Margin Requirements and Account window, you can find out the trading risks by calculating the initial margin and maintenance margin requirements (while holding a position) online.

- TWS Account Window

The account window allows the trader to have complete control over the account, as well as calculate the margin. We show the basic values of the account by default during the launch of the terminal, but you can customize the values as you like.

The information in the account window is shown in real time.

- Margin

Margin is provided by margin prior to order submission. In the trading window, right-click and select Preview Order / Check Margin. Your commission is also displayed.

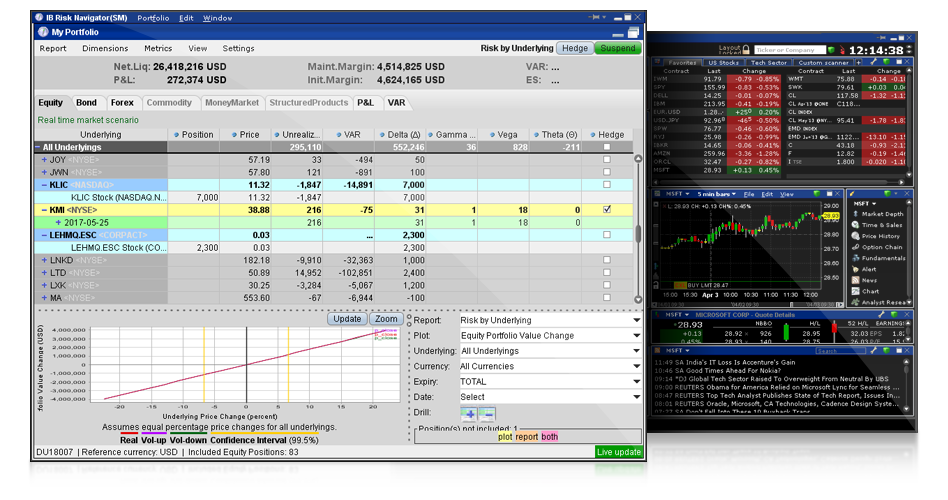

Risk Navigator

Risk Navigator monitors market risks in real time and provides deep risk metrics across multiple asset classes around the world simultaneously.

An easy-to-read tabular data interface allows you to instantly determine the risk exposure of a client's portfolio with detailed reports and overviews.

Risk Navigator gives traders the following benefits:

- Monitoring the risk of a trader's portfolio across several asset classes and assessing the risk of individual sections of assets.

- Controlling and viewing the risk for one position.

- In order to optimize your risk portfolio, a complex custom combination of risk by date, price, volatility is created.

- Control, support and position creation during the creation of new portfolios.

- The ability to view the capital allocation with a data update rate of one minute.

- To see the total value of the entire portfolio and a specific asset class, or part of a portfolio, use the Portfolio Relative P&L tab.

- Also, using this tool, you can view the portfolio changes, depending on the percentage change in the value of the underlying asset.

About TWS

- BasketTrader and basket trading in the Trader Workstation platform

- ComboTrader spreads and option combinations

- OptionTrader and options trading in the Trader Workstation platform

- ScaleTrader Orders in Trader Workstation Platform

- Working with BookTrader in the Trader Workstation platform

- Accumulation / Distribution Algorithm for Stocks in the Trader Workstation Platform

- Forex Trading and FXTrader Features in Trader Workstation Platform