The Japanese yen fell to its lowest level since 1986, putting traders on guard

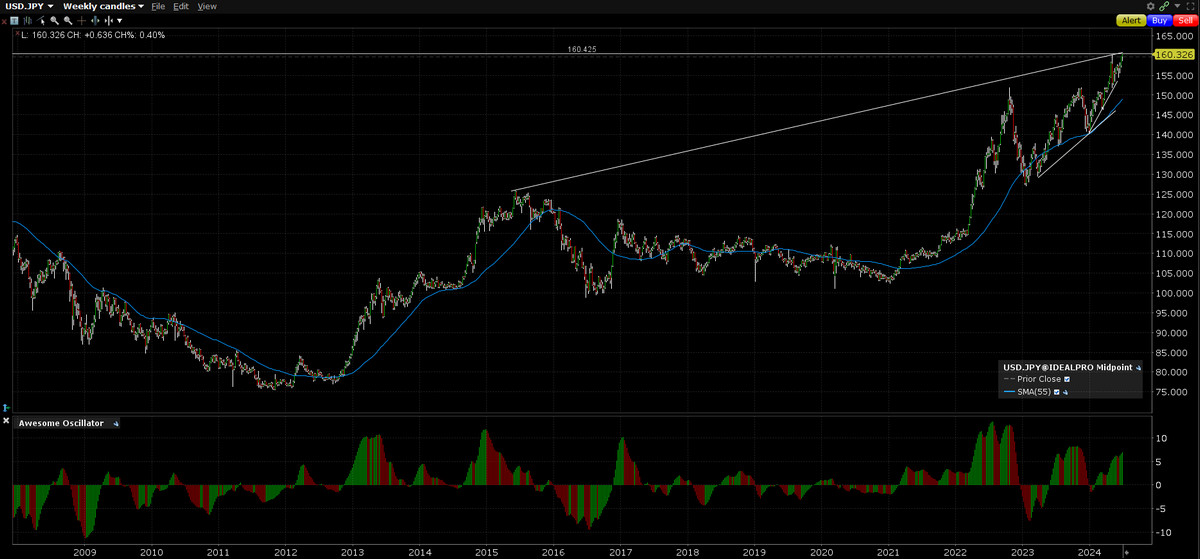

The yen fell to its lowest level since 1986 against the US dollar on Wednesday, leaving currency markets on alert for any sign of intervention by Japanese authorities to shore up the beleaguered currency.

USDJPY traded at 160.39 yen, a level last seen in December 1986, as the wide interest rate gap between the two countries continued to weigh on Japan's currency.

Analysts say traders are testing the resolve of Japan's Treasury and central bank, which spent $62 billion in late April and early May to prop up the currency as it fell above 160.

“If the underlying dynamics don't change along with the yield differential, it will continue to be punished,” said Joe Tuckey, head of currency analysis at broker Argentex.

So-called carry trade strategies, in which investors borrow in low-yielding currencies to invest in higher-yielding currencies, have become extremely popular as some countries have raised borrowing costs in recent years.

While Japan has raised interest rates this year to a range of 0% to 0.1%, US rates of 5.25% to 5.5% mean investors are seeking higher yields on dollar assets, pushing the currency higher against to the yen.

Chief currency diplomat Masato Kanda said on Monday that Japan had always been ready to take action against excessive market movements, but traders ignored the warning after the latest wave of interventions did little to stem the selling.

“Perhaps a few months ago the market would have listened to this more than it does now because it is not backed by any rate changes,” Taki said.

There is a possibility of further rate hikes by the Bank of Japan at the end of July, which could help support the yen. But any sustained rally would likely require the Federal Reserve to cut interest rates.

The DXY dollar index, which tracks the currency against six peers, rose 0.3% to 105.99, its highest level since May 1.

Friday's US Consumer Expenditure Expenditure (PCE) report will be key for currency markets. The lower-than-expected figure could prompt traders to raise their bets on the Fed cutting rates this year, providing some relief for the yen.

The euro fell 0.3% to $1.0683 after a European Central Bank policymaker said there was a chance of further rate cuts this year, a marked departure from the Fed's Michelle Bowman.

ECB governing council member Olli Rehn told Bloomberg that two more cuts this year seemed “reasonable.” That contrasted with Fed Chair Bowman, who said she doesn't expect any U.S. rate cuts this year.

Inflation in Australia accelerated to a six-month high of 4% in May, prompting traders to rush into prices on fears of further rate hikes by November, sending the Australian dollar lower.

AUDUSD rose 0.5% before cooling to rise 0.1% to $0.6656.

Sterling GBPUSD fell 0.3% to $1.2647 as the dollar strengthened.

The yuan also came under pressure from the dollar's stubborn strength, and China appeared to signal some tolerance for the cheaper currency, gradually weakening the midpoint of the yuan's daily trading range against the dollar.

The yuan, which had hovered near the bottom of its band for months, fell to a seven-month low of 7.2671 per dollar on Wednesday.