Forecast and analysis of EURUSD and EURGBP pairs in the Forex currency market

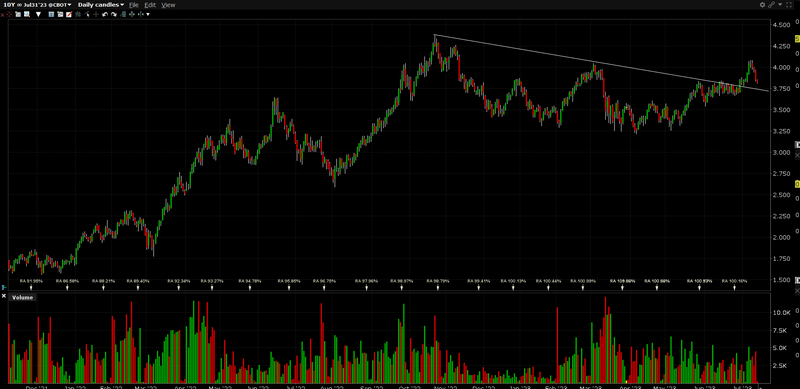

The latest US inflation report showed that price pressures have eased more than expected, a much-needed boost for the Federal Reserve as they continue to fight inflation. The news caused US Treasury yields to fall further as traders continue to forecast links to higher US interest rates. The Fed is expected to raise rates by 25 basis points at the end of this month, but with declining inflation, they may have more room to keep rates unchanged in the coming months. The recent sell-off in bond yields and weakness in the US dollar support the idea of a peak rate. Interest rate sensitive 10Y futures lost 40 basis points last week.

This weakness in the US dollar can be clearly seen against the euro as the EUR/USD pair returned to highs from about 15 months ago. The previous highs of resistance, reached in mid-April-early May, were broken yesterday in one daily candle, and if the pair consolidates above 1.1096, then these old resistance levels may turn into support levels. The CCI indicator at the bottom of the chart shows that the pair is heavily overbought, so this needs to be normalized before the EUR/USD can move further. The next resistance level is near 1.1185, after which 1.1250 comes into consideration.

EURUSD daily chart

Retail data shows that 28.45% of traders are net long, with a short to long ratio of 2.52 to 1. The number of net long traders is 4.10% lower than yesterday and down 35.07% lower than last week, while traders' net short positions are 6.15% higher than yesterday and 38.55% higher than last week.

We usually take the opposite view of crowd sentiment and the fact that traders are covering short positions suggests that GBPUSD prices may continue to rise. Traders are covering more short positions than yesterday and last week, and the combination of current sentiment and recent developments gives us a stronger contrarian bull trade in the GBPUSD pair.

UK economy shrinks less than expected in May, GBPUSD breaks 1.3000

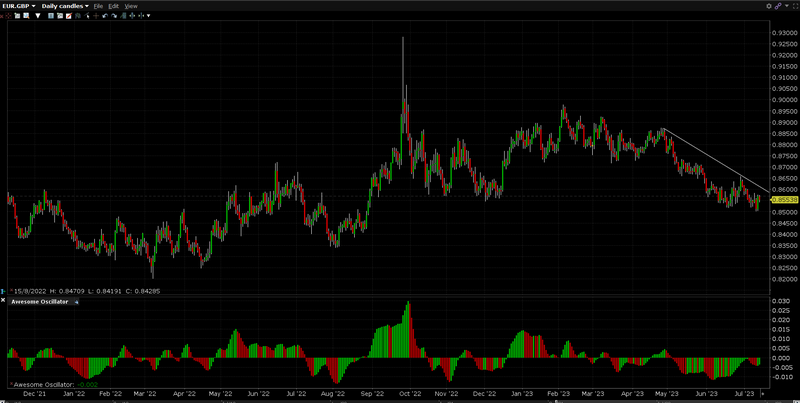

EURGBP is another story, the pair continues to decline. The EURUSD hit a multi-month high of 0.8979 in early February and has been moving down ever since, making a continuous series of lower highs and lower lows. The pound sterling continues to be supported by elevated bond yields and expectations that the Bank of England will continue to raise rates even higher. The wider the difference in interest rates between the British pound and the euro, the lower the EURGBP rate will be.

EURGBP daily chart